Developing Financially Intelligent Citizens

- Academic and Enrichment Coordinator

- May 13, 2024

- 2 min read

AYTEF was buzzing with excitement as we delved into the fascinating world of money management through a series of engaging activities and projects!

We kicked off our learning by immersing ourselves in the realm of games. Monopoly, Life, Making Change, you name it! These classic games served as the perfect gateway to introduce the concept of money, budgets, and decision-making to our eager young minds. Through strategic gameplay, the students began to grasp the importance of budgeting, investing, and making wise financial choices.

Next up, we embarked on a mini-project designed to simulate real-life financial scenarios. Our students took on the roles of responsible adults choosing a occupation, navigating through the intricacies of paying essential bills while also contemplating indulgent purchases such as technology gadgets. This hands-on experience provided invaluable insights into the practical aspects of managing finances, highlighting the delicate balance between needs and wants.

With a solid foundation laid, we delved deeper into the realm of savings and interests. Drawing inspiration from the timeless tale of "One Grain of Rice," the students embarked on a captivating journey alongside the protagonist, discovering the power of compound interest and the magic of saving. Witnessing the protagonist's exponential growth in wealth through a simple act of generosity, the students were inspired to harness the potential of savings and investments in their own lives.

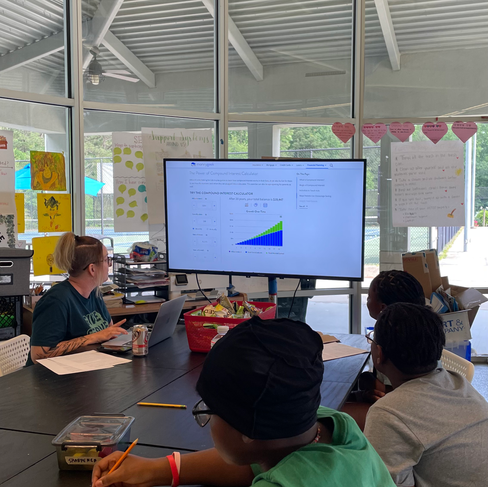

To reinforce these concepts, we engaged in interactive activities such as an interest tracker simulation. By inputting various scenarios, the students gained a firsthand understanding of how different factors such as time, initial investment, and monthly deposits can influence the growth of wealth over time. It was truly eye-opening to witness the profound impact of compounding interest on long-term financial goals.

But perhaps the highlight of our session was the hands-on experiment with M&Ms, where the younger students stepped into the shoes of working adults. Tasked with the decision to either save or spend their "paycheck" (represented by delicious M&Ms) each pay period, they experienced firsthand the consequences of their financial choices. Through this playful yet insightful activity, the students realized the importance of cultivating a habit of saving and the rewards it can yield over time.

As our session drew to a close, the students left with a newfound sense of confidence and competence in managing their finances. Armed with practical skills and a deeper understanding of financial principles, they are better equipped to navigate the complexities of the modern world with financial resilience and independence.

Comments